Planning ahead for your taxes is always a smart move. It can save you time and money in the long run. One important form to consider is the 2025 IRS Form 709 Printable, which deals with gift taxes.

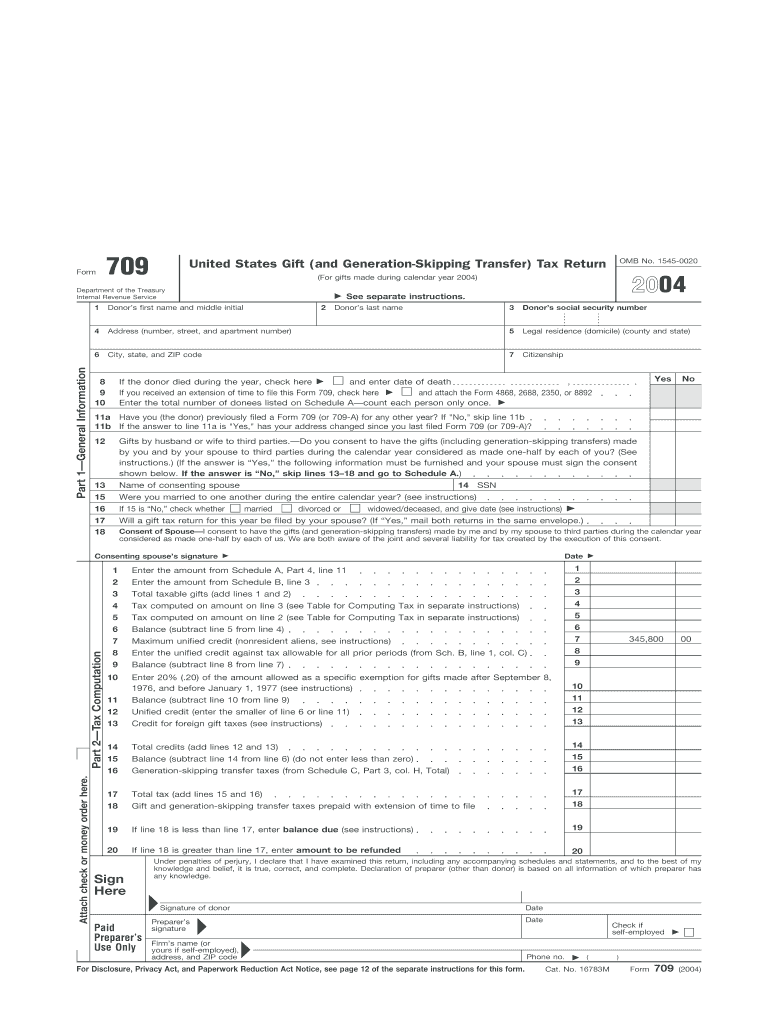

Gift taxes are a way for the government to ensure that individuals are not avoiding estate taxes by giving away their assets before they pass away. The IRS Form 709 is used to report gifts that exceed the annual exclusion amount, which is currently $15,000 per person.

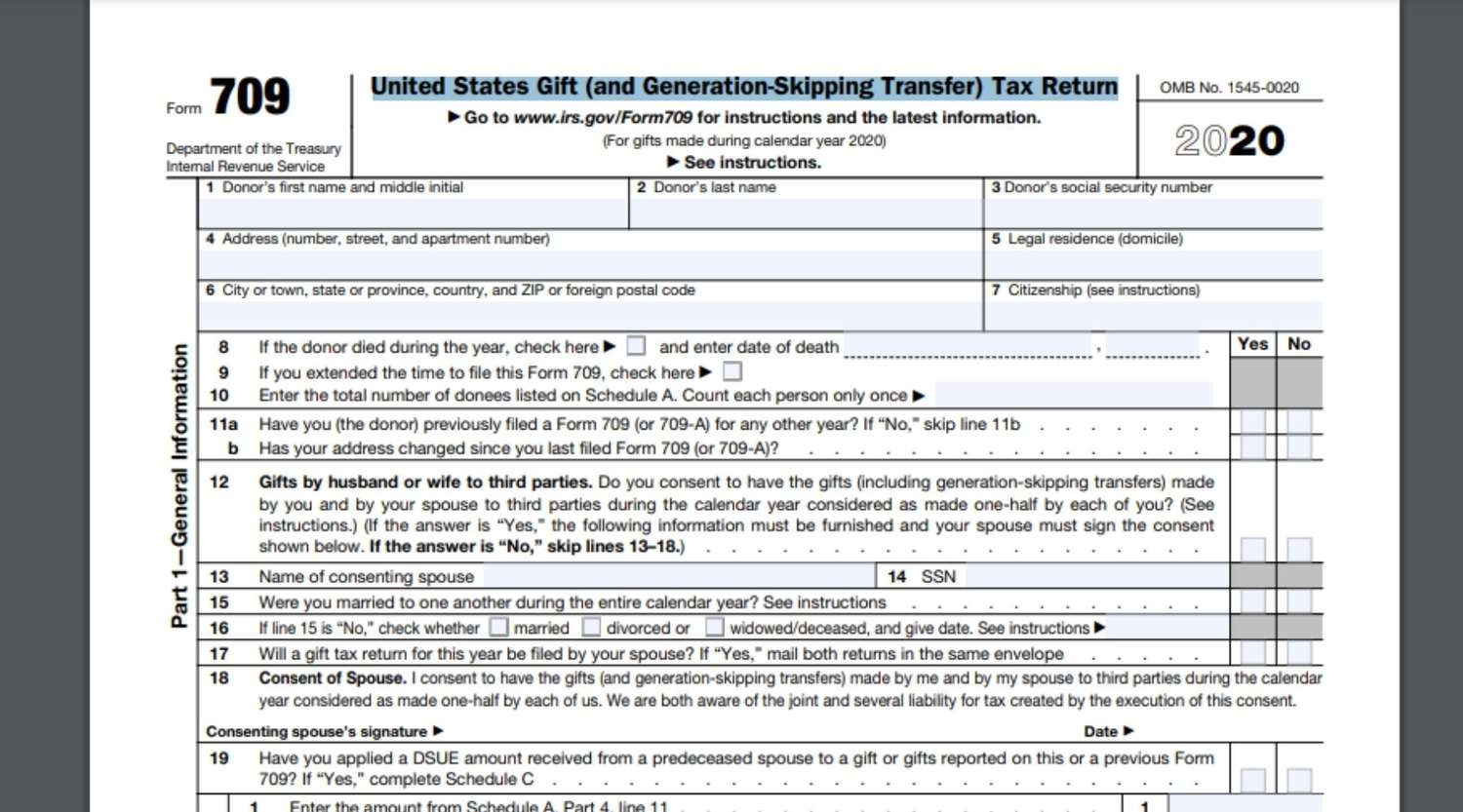

2025 – 2025 Irs Form 709 Printable

2025 IRS Form 709 Printable: What You Need to Know

When you give a gift to someone that exceeds the annual exclusion amount, you are required to file Form 709 with the IRS. This form helps the IRS keep track of the value of gifts you have given over your lifetime.

It’s important to note that not all gifts are taxable. For example, gifts to your spouse, donations to qualifying charities, and payments made directly to educational or medical institutions for someone’s benefit are usually not subject to gift tax.

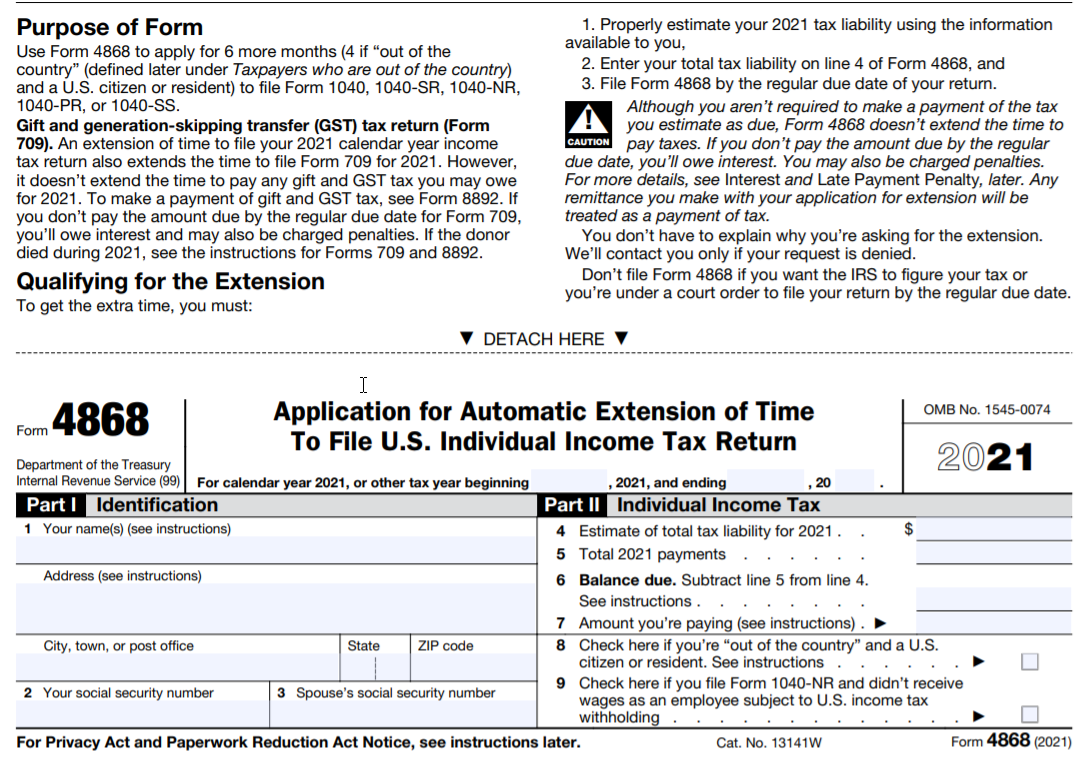

However, if you give a gift to someone and it exceeds the annual exclusion amount, you will need to file Form 709. This form is due by April 15 of the year following the year in which the gift was made.

By staying informed about the IRS Form 709 and understanding how gift taxes work, you can ensure that you are in compliance with the law and avoid any potential penalties. Consulting with a tax professional can also provide you with valuable guidance on how to navigate the complexities of gift tax laws.

Remember, planning ahead and staying organized when it comes to your taxes can make a big difference in your financial future. So, if you anticipate making gifts that exceed the annual exclusion amount, be sure to familiarize yourself with the 2025 IRS Form 709 Printable and file it accordingly.

Form 709 What It Is And Who Must File It

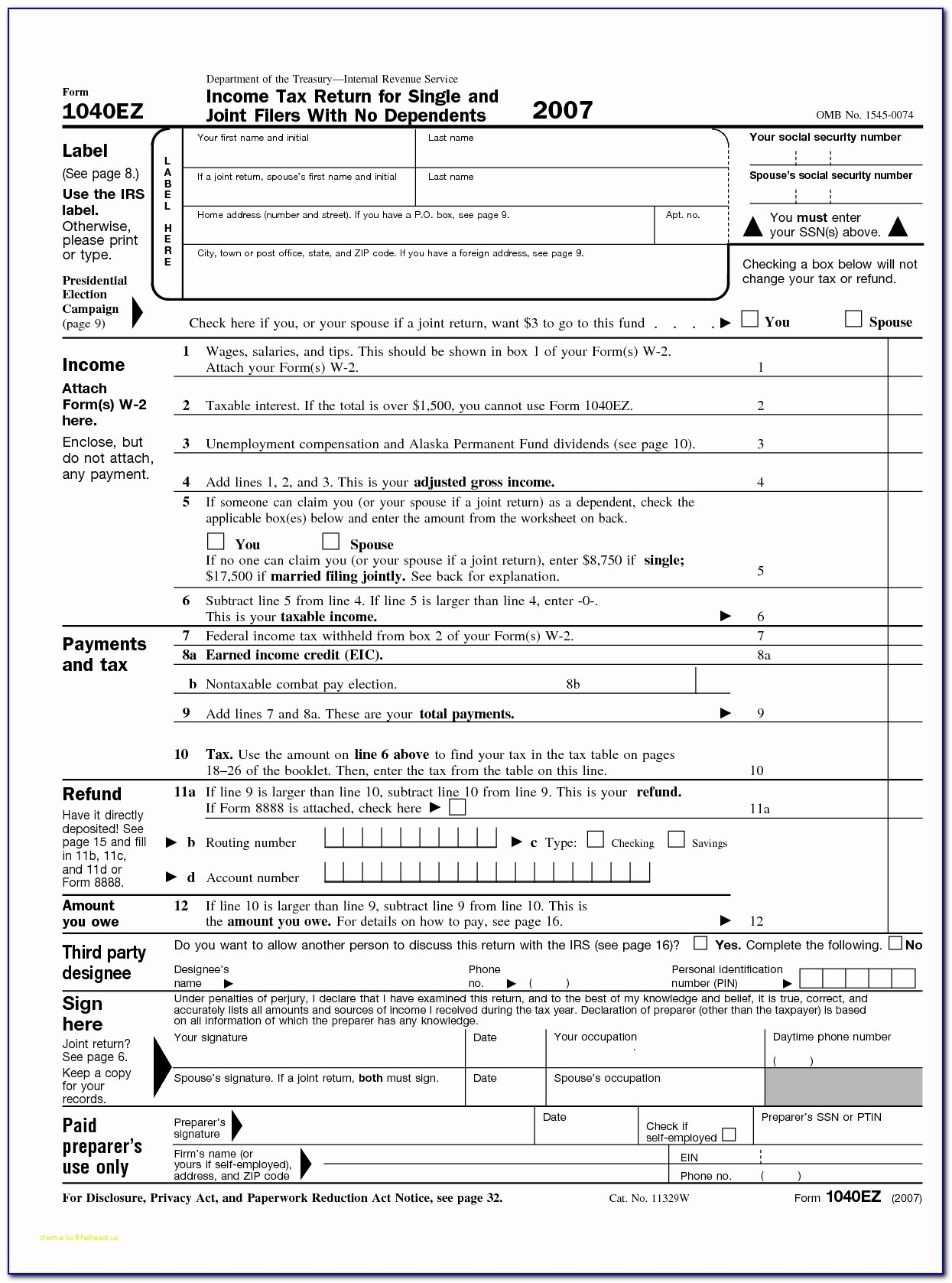

Irs 2025 Tax Forms 2025 Christian J Johnsen

Irs Form 709 For 2025 Sam Berry

IRS 709 2022 2025 Fill And Sign Printable Template Online