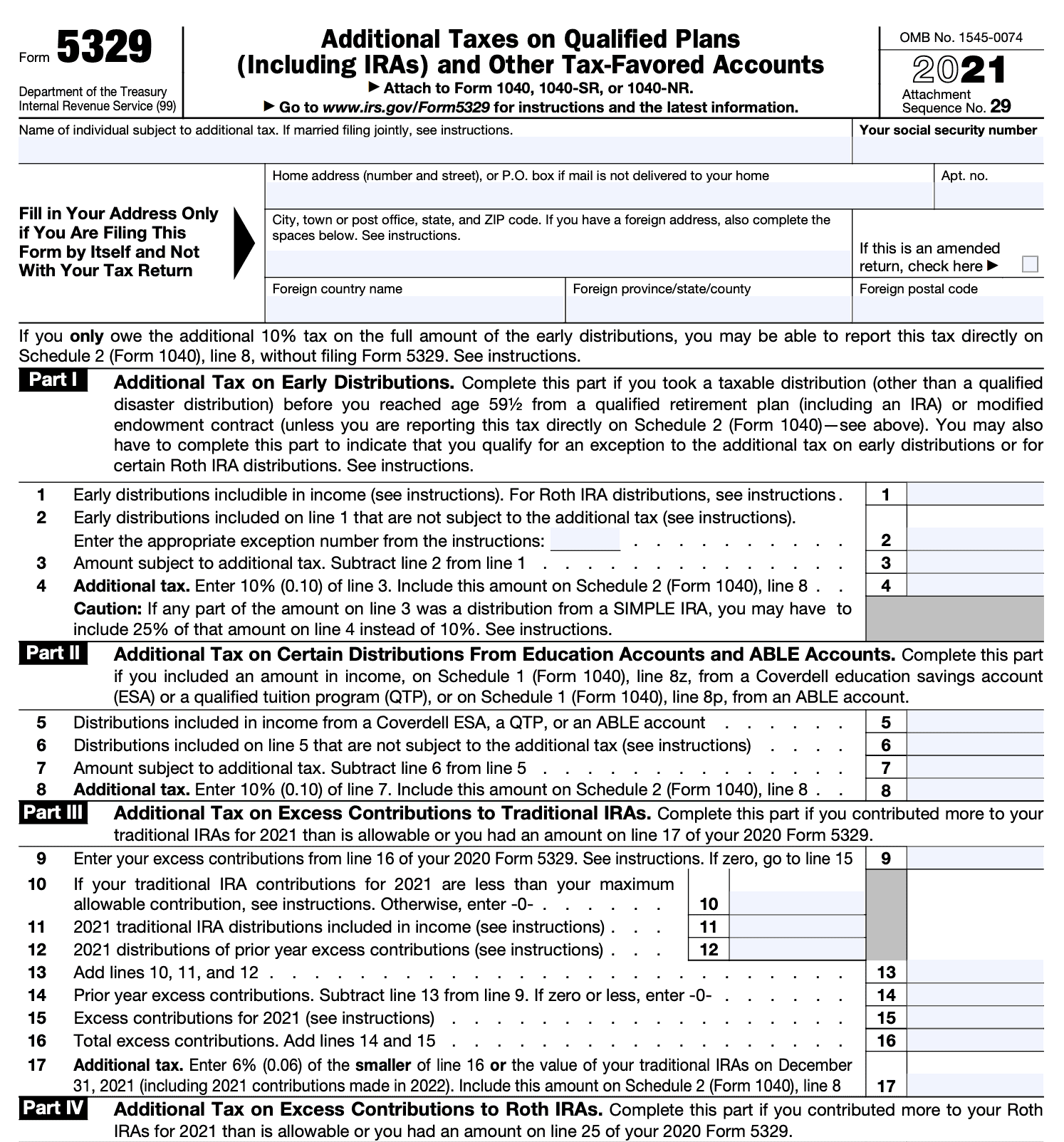

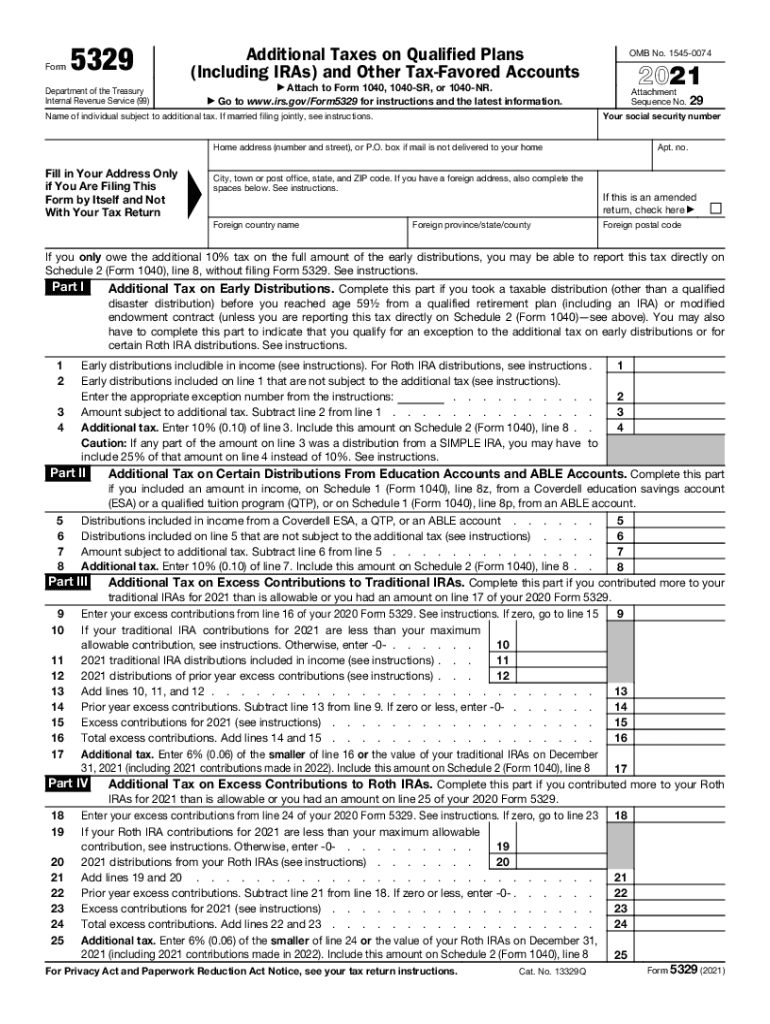

Are you looking for an easy way to file your taxes in 2025? One essential form you may need is the IRS Form 5329. This form is used to report additional taxes on retirement accounts and other qualified plans.

When it comes to tax season, having the right forms on hand is crucial. The IRS Form 5329 for 2025 printable version can be a lifesaver. By having this form readily available, you can quickly and accurately report any additional taxes owed on your retirement accounts.

2025 – Irs Form 5329 For 2025 Printable

Irs Form 5329 For 2025 Printable

Whether you’re filing your taxes online or through a tax professional, having the IRS Form 5329 for 2025 printable version can streamline the process. This form allows you to report any penalties or additional taxes on your retirement accounts with ease.

By filling out the IRS Form 5329 accurately, you can avoid any potential penalties or issues with the IRS. This form is essential for anyone who has made early withdrawals from their retirement accounts or other qualified plans.

Don’t let tax season stress you out. With the IRS Form 5329 for 2025 printable version, you can easily report any additional taxes owed on your retirement accounts. Having this form on hand will make the tax-filing process smoother and more efficient.

Make sure to double-check all the information on your IRS Form 5329 before submitting it. Accuracy is key when it comes to filing your taxes, so take the time to review your form and ensure all the necessary information is correct. By doing so, you can avoid any potential issues with the IRS.

So, if you’re preparing to file your taxes for 2025, be sure to have the IRS Form 5329 for 2025 printable version on hand. This form can help you accurately report any additional taxes owed on your retirement accounts, making the tax-filing process a breeze.

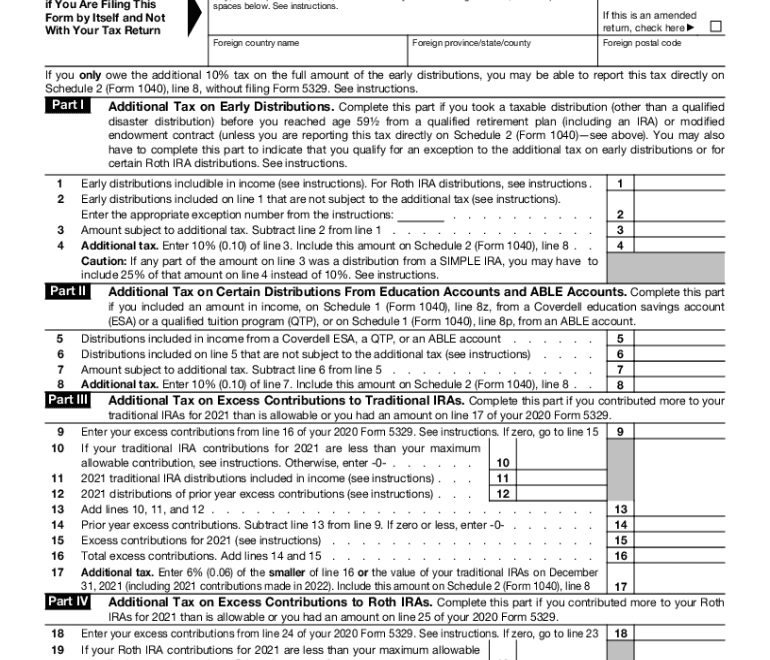

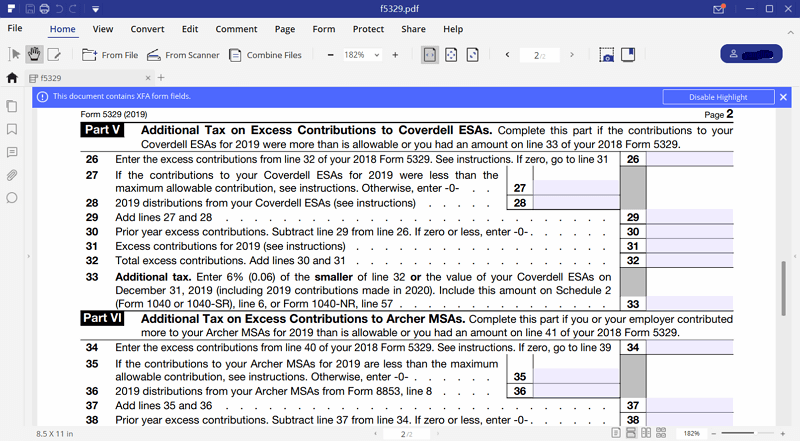

IRS Form 5329 A Complete Guide To Additional Taxes

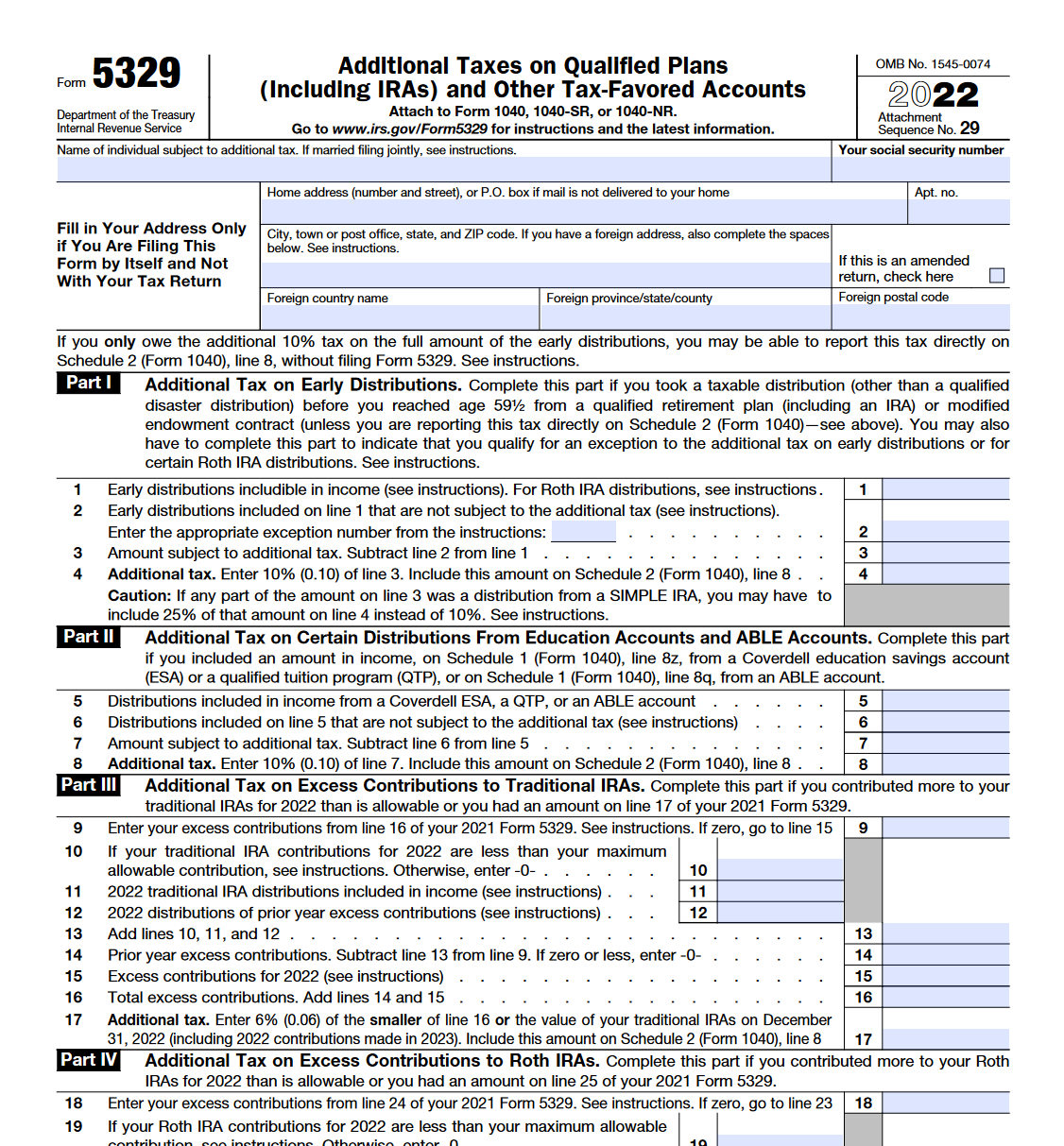

IRS Form 5329 Additional Taxes On Qualified Plans Forms Docs 2023

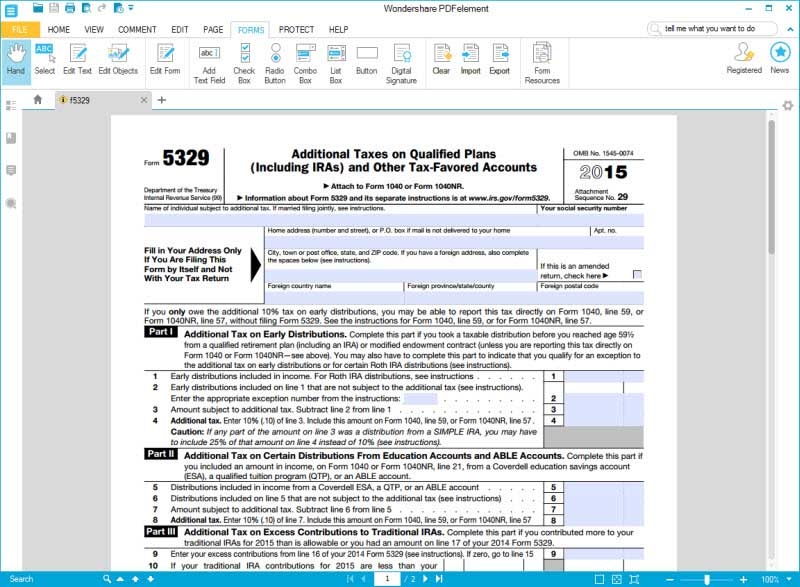

How To Fill In IRS Form 5329

Form 5329 Pdf Fill Out Sign Online DocHub