Planning to spend a substantial amount of time in the US as a Canadian citizen in 2025? Then you may need to file IRS Form 8840 to prove you’re not a US resident for tax purposes. Don’t worry, we’ve got you covered!

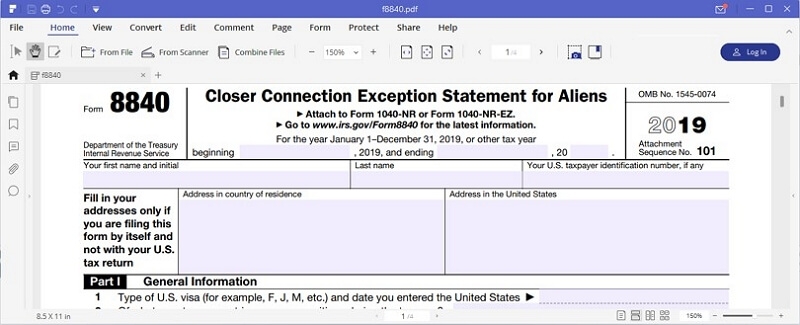

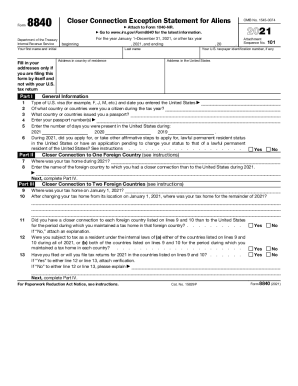

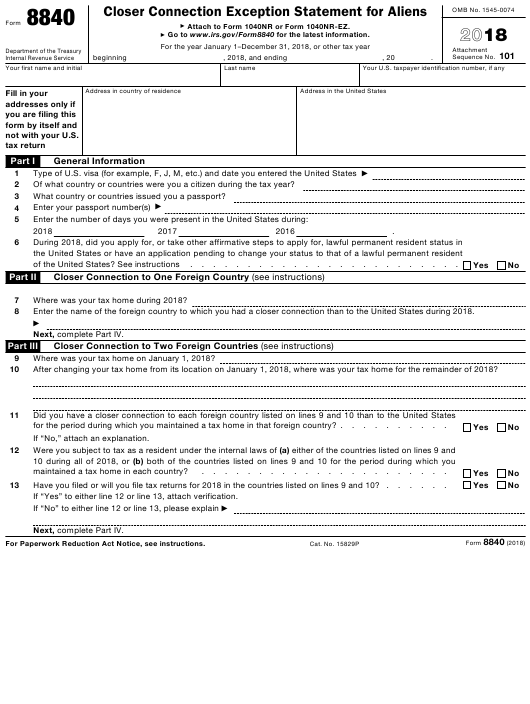

IRS Form 8840, also known as the Closer Connection Exception Statement for Aliens, is a crucial document for Canadians who spend an extended period in the US and want to avoid being considered a US tax resident. Filing this form ensures you maintain your non-resident status and the tax benefits that come with it.

2025 – Irs Form 8840 For 2025 Printable

Irs Form 8840 For 2025 Printable

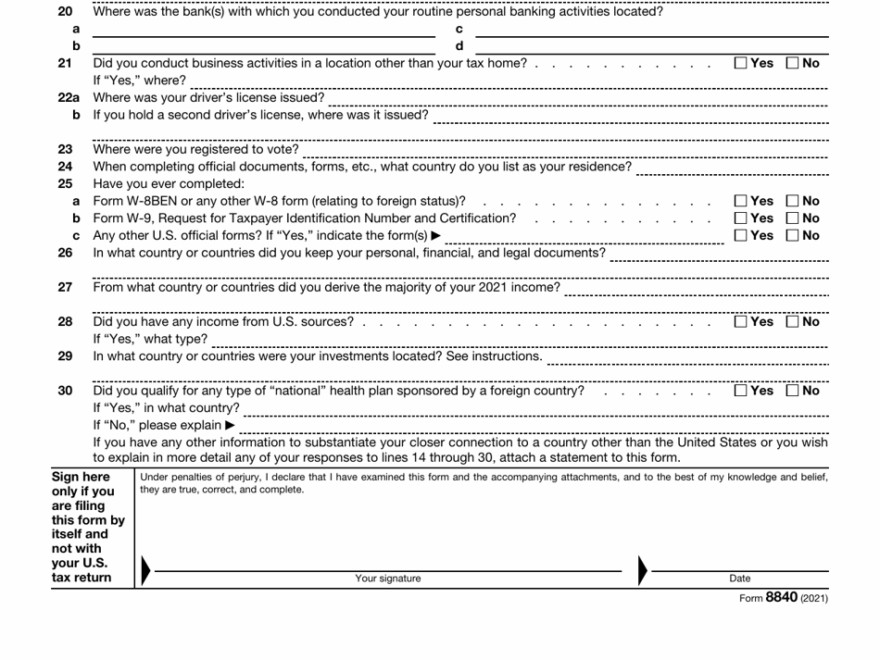

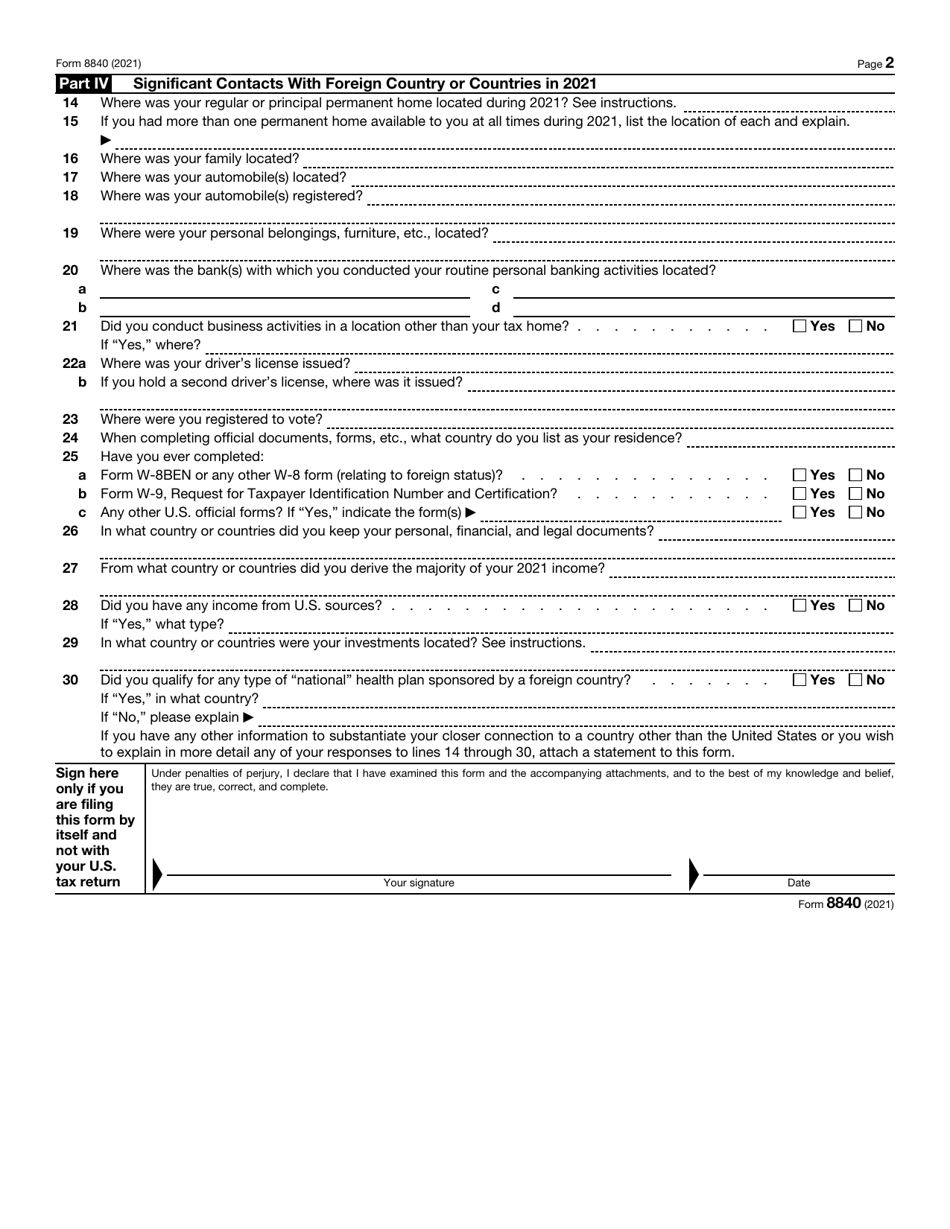

Completing Form 8840 is simple and straightforward. The form requires you to provide basic information about yourself, such as your name, address, and social security number (if applicable). You’ll also need to answer a series of questions to demonstrate your closer connection to Canada than the US.

Make sure to keep detailed records of your time spent in each country, including travel dates, employment status, and ties to each country. This information will help support your claim of closer connection to Canada and ensure a smooth filing process.

Once you’ve completed the form, you can easily print it out and mail it to the IRS. Remember to keep a copy for your records and submit it by the deadline to avoid any potential tax implications. If you have any questions or need assistance, don’t hesitate to reach out to a tax professional for guidance.

By filing IRS Form 8840 for 2025, you can enjoy your time in the US without worrying about tax residency issues. So, take a few minutes to fill out the form, stay compliant with US tax laws, and continue to benefit from the special tax treatment available to Canadian non-residents.

IRS Form 8840 How To Fill It Right And Easily

IRS 8840 2021 2025 Fill And Sign Printable Template Online

Irs Form 8840 Printable Printable Form 2024

Irs Form 8840 Fillable Pdf Printable Forms Free Online