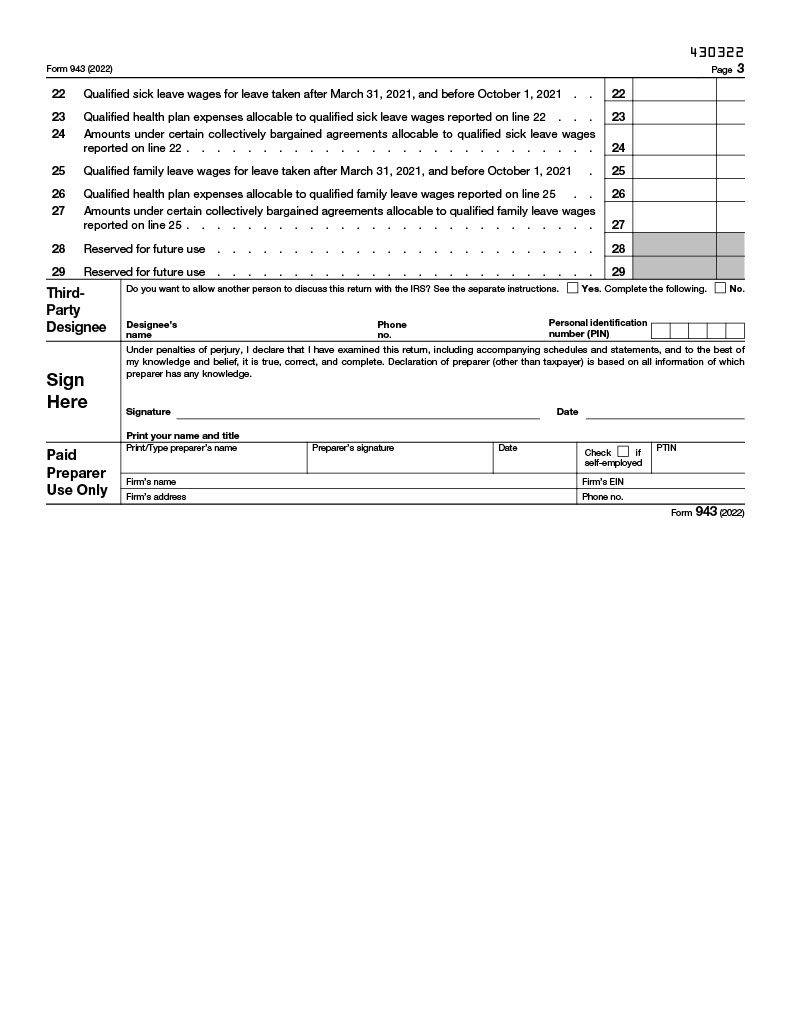

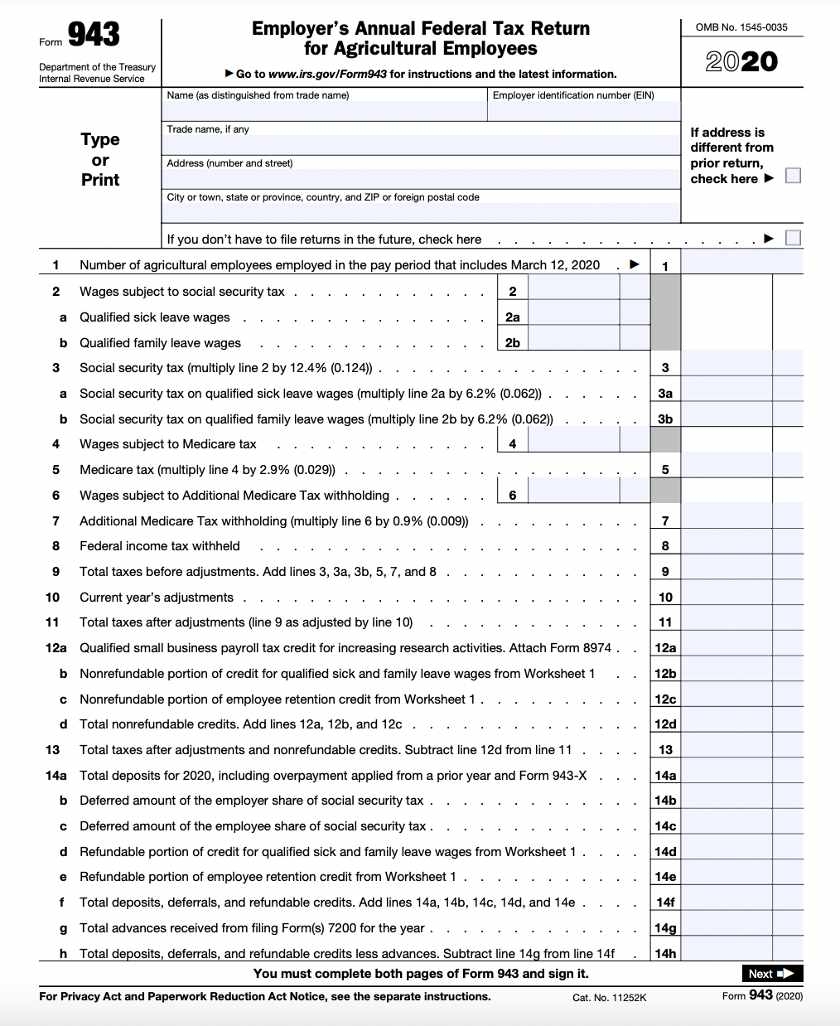

Are you a small business owner looking for a simple way to file your federal employment taxes? Look no further than IRS Form 943 for 2025. This printable form makes it easy to report your agricultural employees’ wages and taxes.

Form 943 is designed for employers who pay agricultural workers more than $150 in cash wages during the year. It’s important to file this form accurately and on time to avoid penalties from the IRS. With the printable version for 2025, you can easily fill it out and submit it without any hassle.

2025 – Irs Form 943 For 2025 Printable

Understanding IRS Form 943 for 2025 Printable

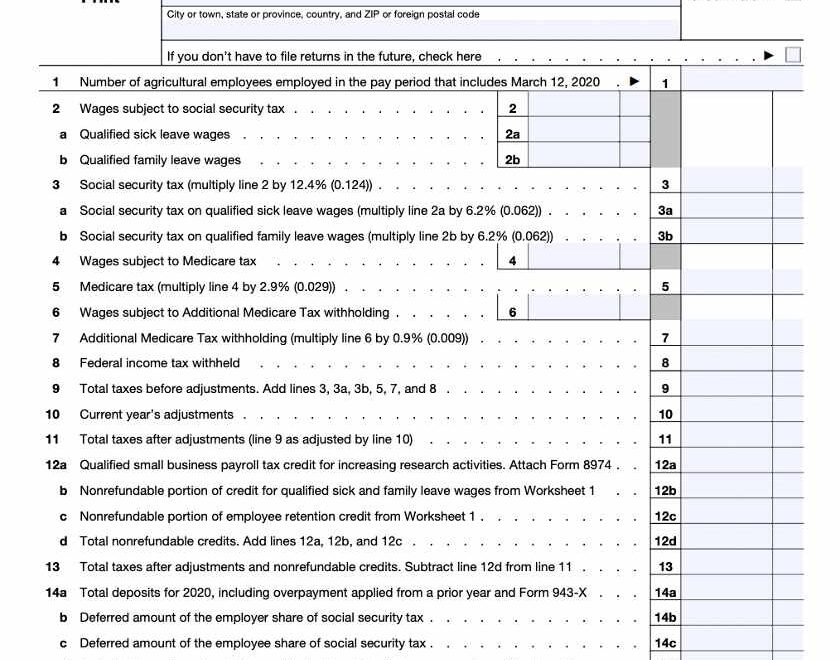

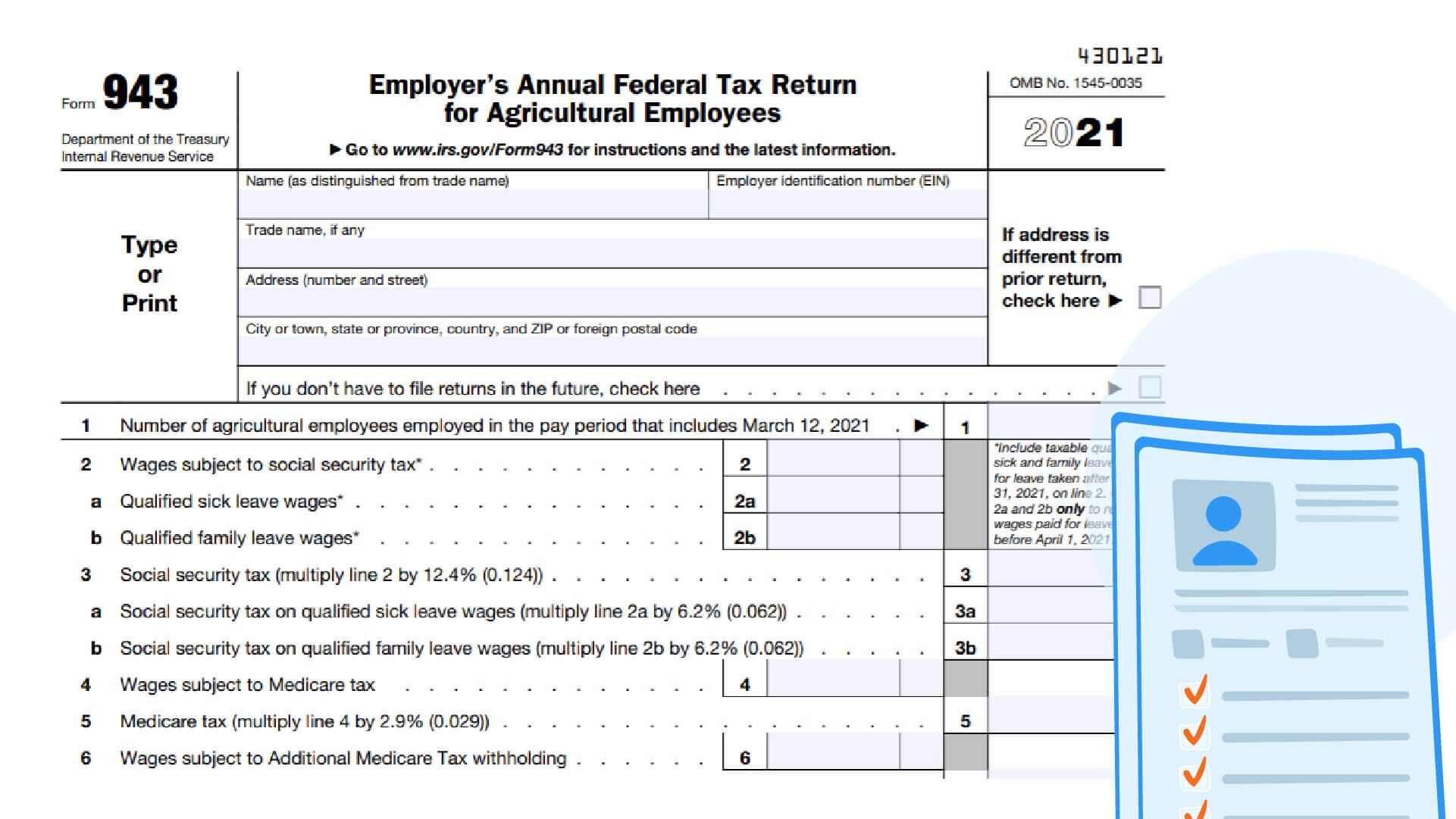

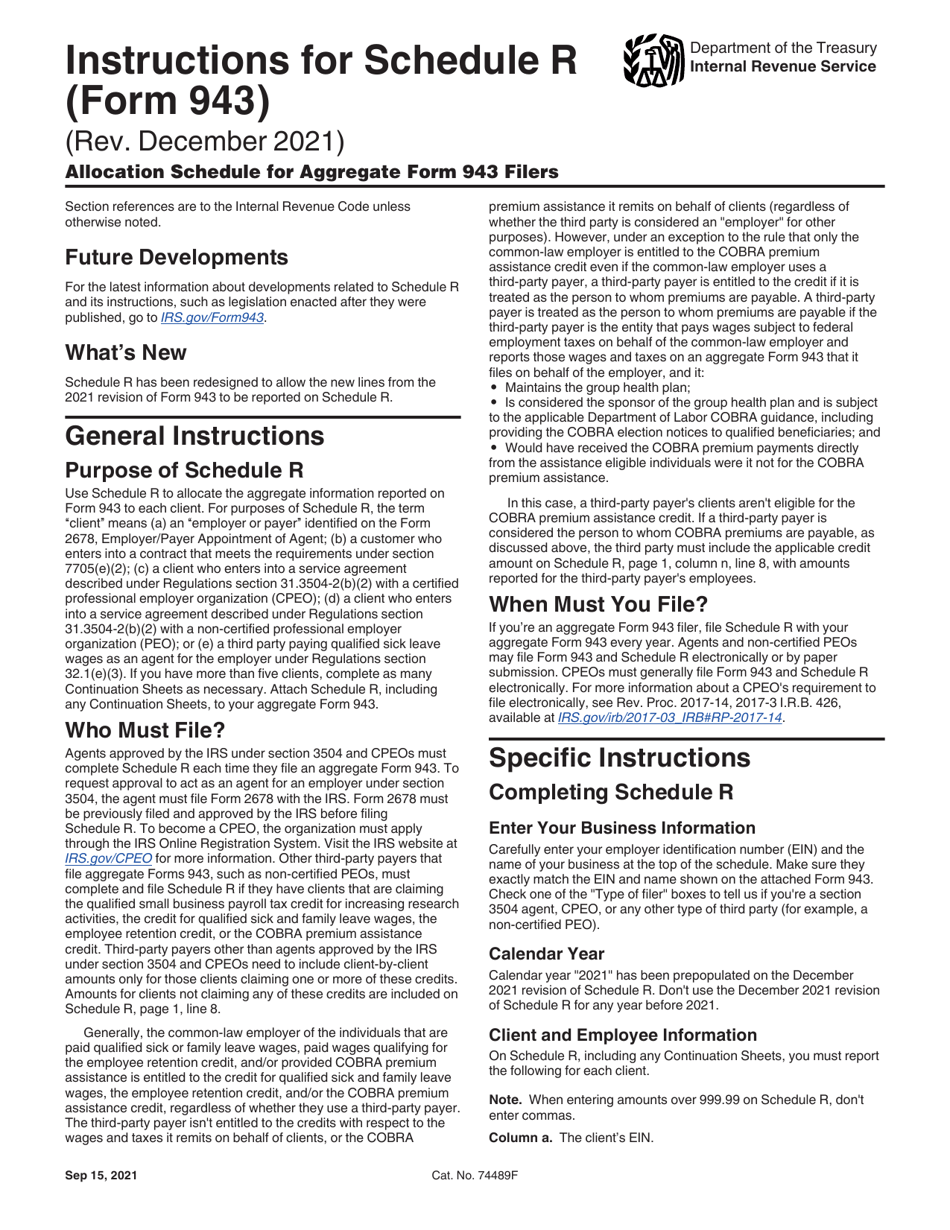

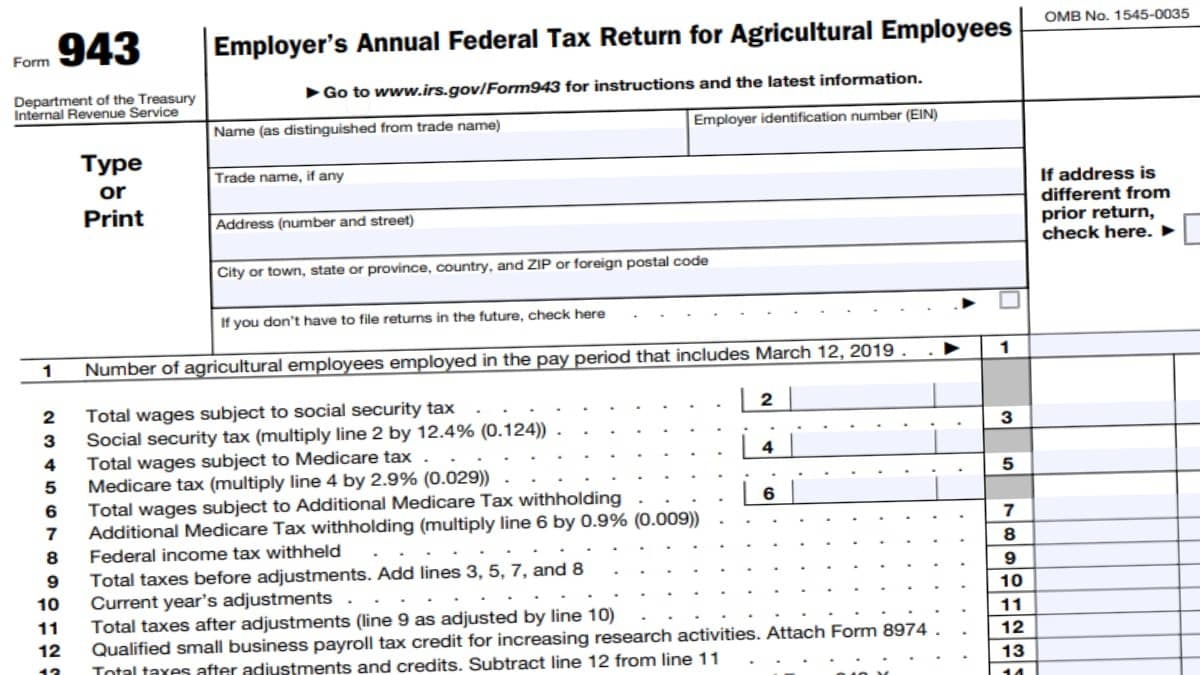

When filling out Form 943, you’ll need to provide information about your agricultural employees, such as their names, social security numbers, and wages paid. You’ll also need to calculate the total wages subject to federal employment taxes and the amount of tax due.

Once you’ve completed the form, you can either mail it to the IRS or file it electronically. Be sure to keep a copy for your records and make any necessary payments by the due date to avoid any penalties. The IRS offers resources and guidance to help you navigate the process if you have any questions.

Using the IRS Form 943 for 2025 printable version simplifies the process and ensures that you meet your tax obligations as a small business owner. By staying organized and submitting accurate information, you can avoid costly mistakes and focus on growing your business.

Take advantage of this convenient tool to streamline your tax filing process and stay compliant with federal regulations. With IRS Form 943 for 2025 printable, you can save time and effort while fulfilling your responsibilities as an employer. Don’t let tax season stress you out – use this resource to make it easier on yourself.

Form 943 Instructions 2025 Andre Amills

Form 943 Instructions 2025 Jacob Nasir

2025 Form 943 Instructions Camila Avery

Form 943 Instructions 2025 Alyssa Lyttleton