Are you looking for a way to adjust your tax withholdings? Well, you’re in luck! The IRS Form W-4V is here to help you do just that. By filling out this form, you can make sure the right amount of tax is withheld from your paycheck.

Whether you’re starting a new job, changing your filing status, or simply want to update your withholding amounts, the IRS Form W-4V is a handy tool to have in your financial toolkit. It’s easy to fill out and can make a big difference in your tax situation.

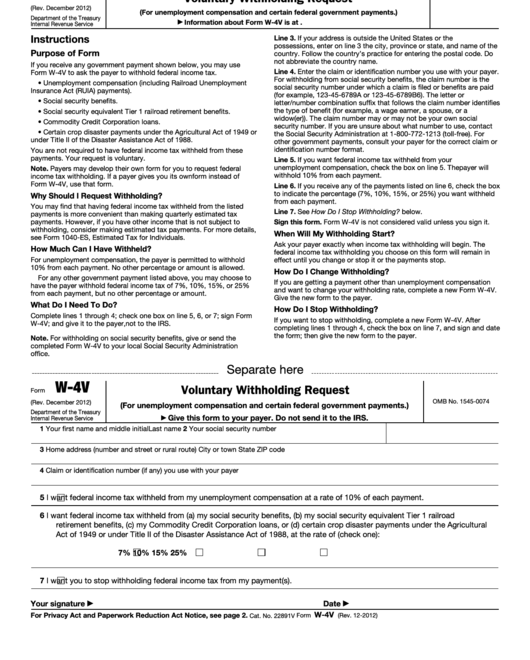

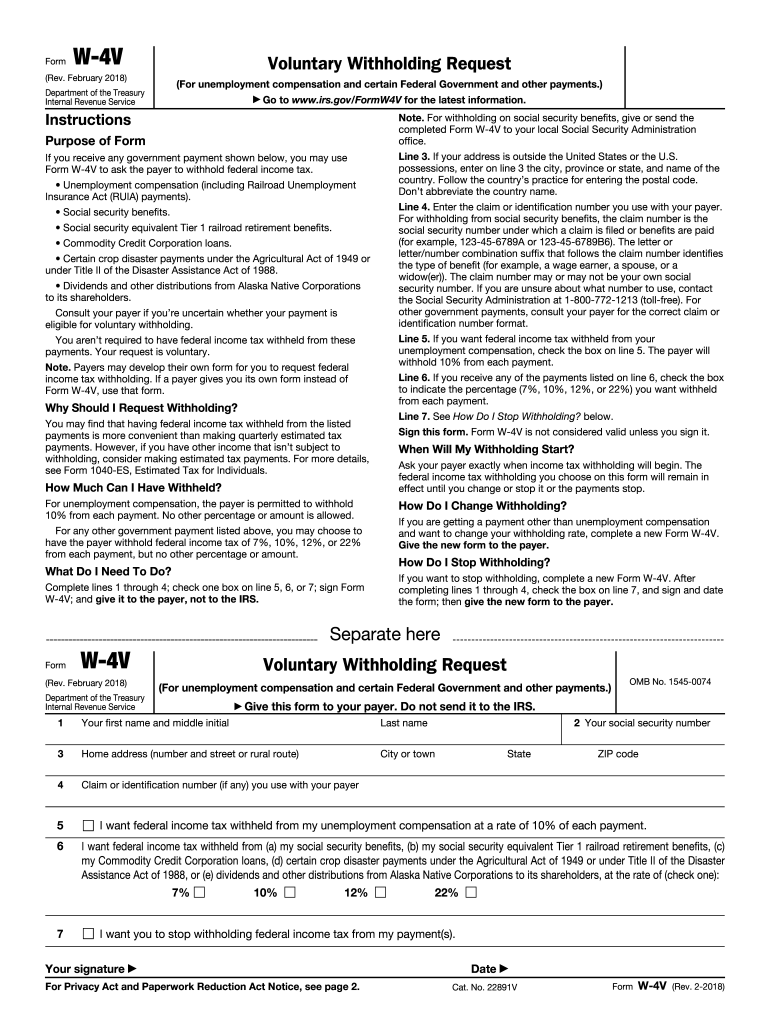

2025 – Printable Irs Form W-4v

Printable IRS Form W-4V

Before you start filling out the IRS Form W-4V, make sure you have all the necessary information on hand. This includes your personal information, filing status, and any additional withholding amounts you want to specify. Once you have everything ready, you can easily access a printable version of the form online.

Once you’ve filled out the form, make sure to submit it to your employer as soon as possible. This will ensure that the correct amount of tax is withheld from your paycheck moving forward. And remember, you can always update your withholding amounts by filling out a new Form W-4V if your financial situation changes.

By taking the time to fill out the IRS Form W-4V, you can make sure that you’re not overpaying or underpaying your taxes throughout the year. This can help you avoid any surprises come tax time and ensure that you’re on solid financial footing. So don’t wait, get started on your Form W-4V today!

So there you have it – a simple and straightforward way to adjust your tax withholdings with the IRS Form W-4V. By taking a few minutes to fill out this form, you can make sure that you’re on the right track financially and avoid any unnecessary tax headaches. Give it a try and see the difference it can make!

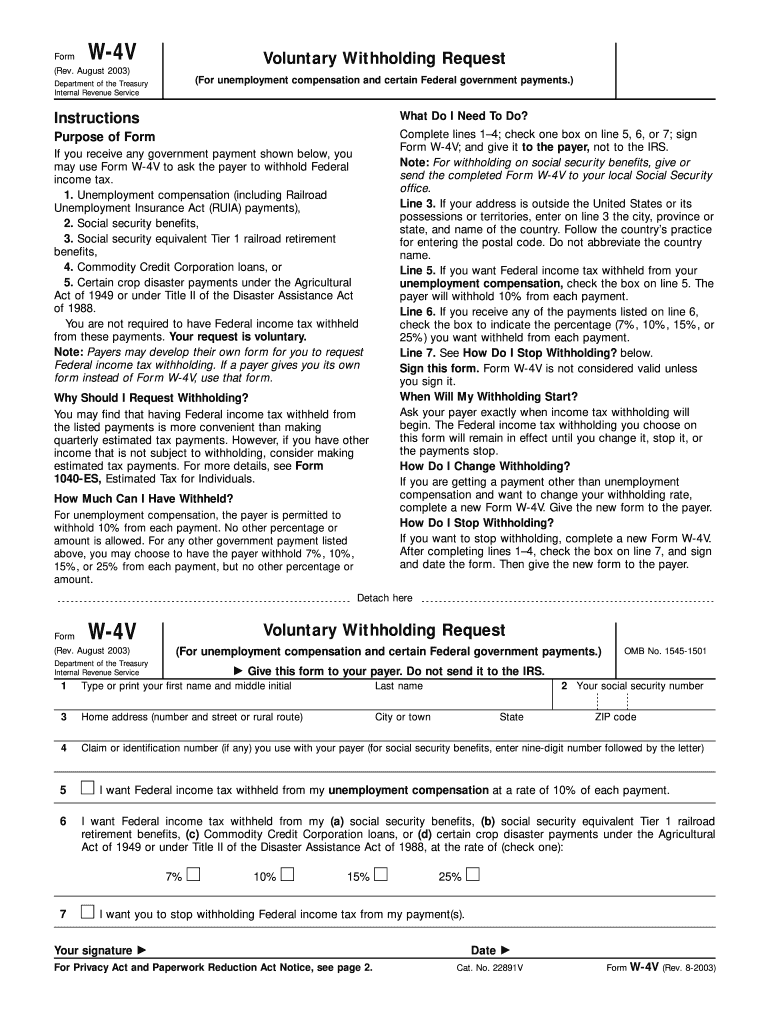

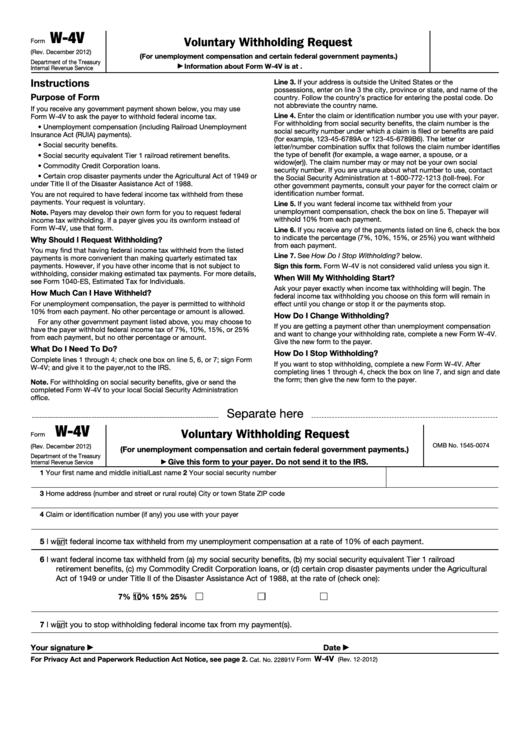

Form W 4v Printable Prntbl concejomunicipaldechinu gov co

W 4V Printable Form

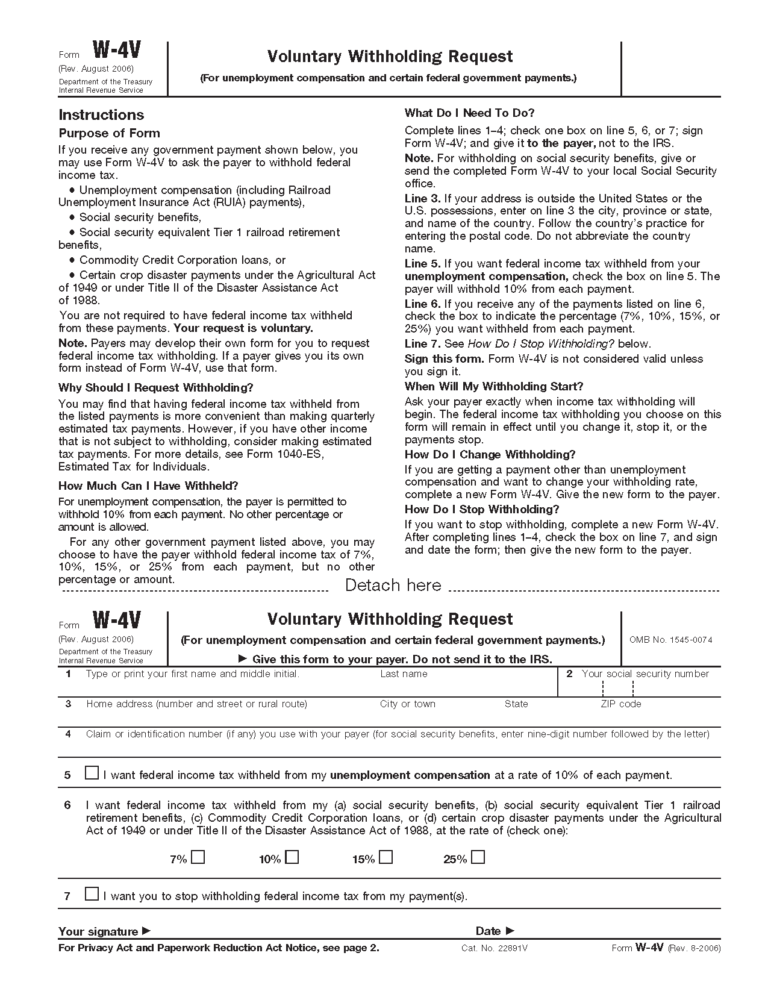

IRS W 4V 2018 2022 Fill And Sign Printable Template Online US Legal

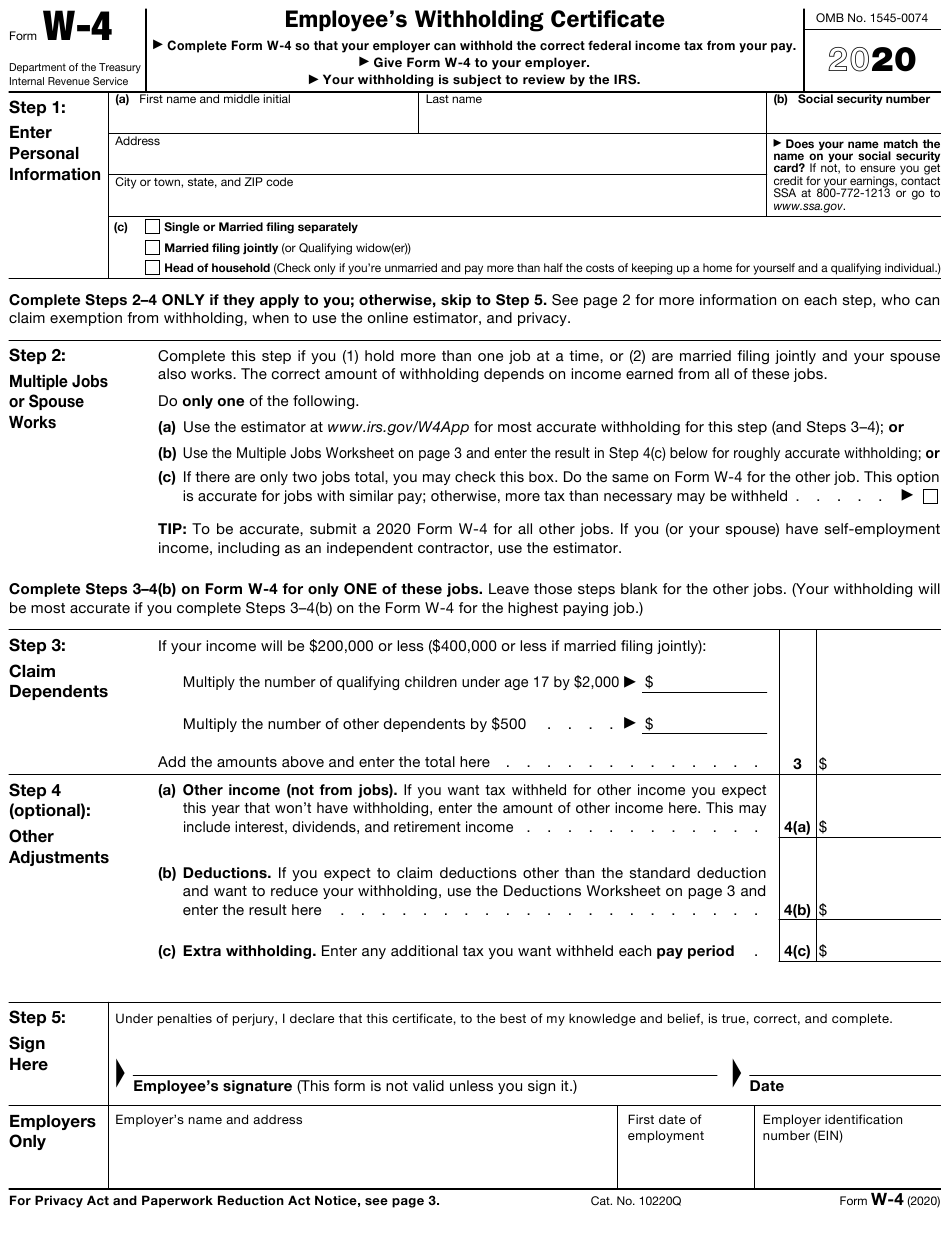

Printable W 4v Form Printable Forms Free Online