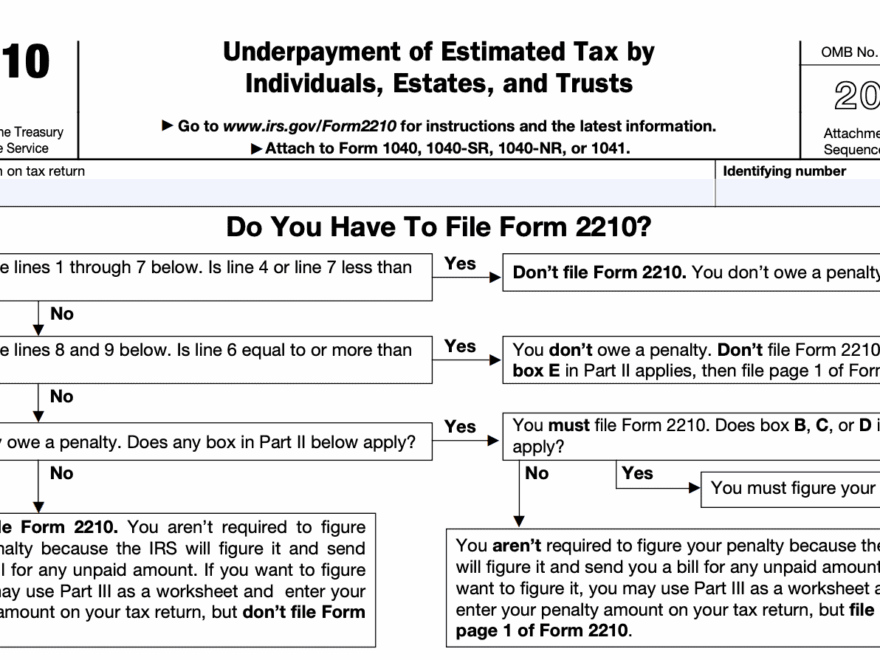

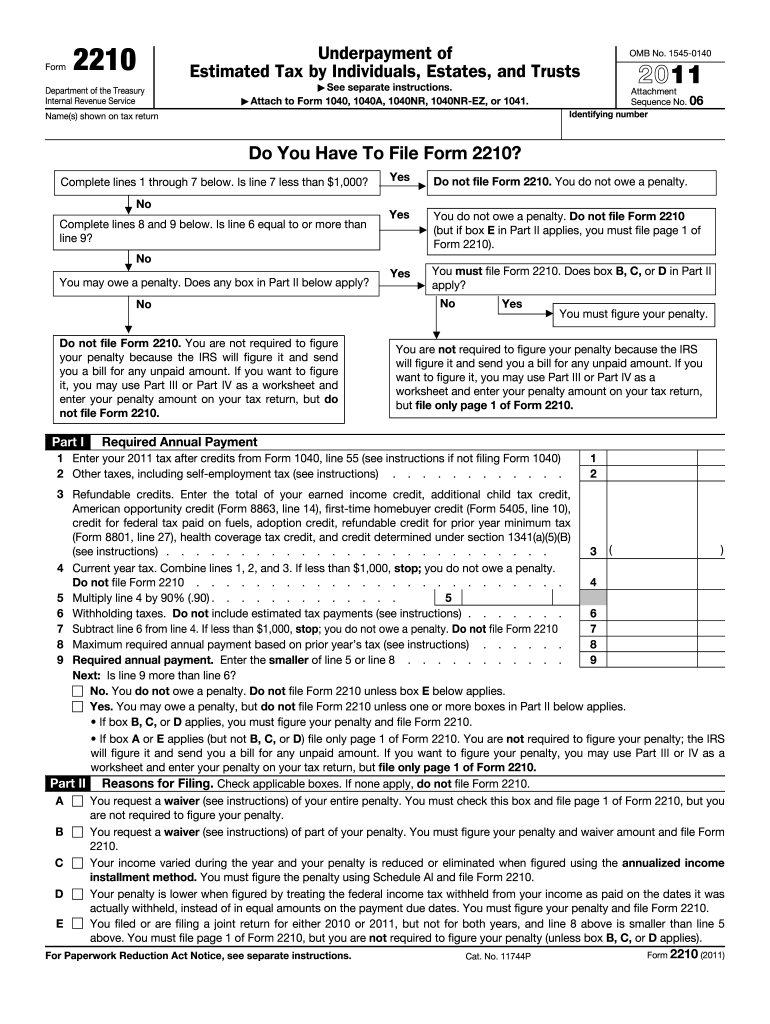

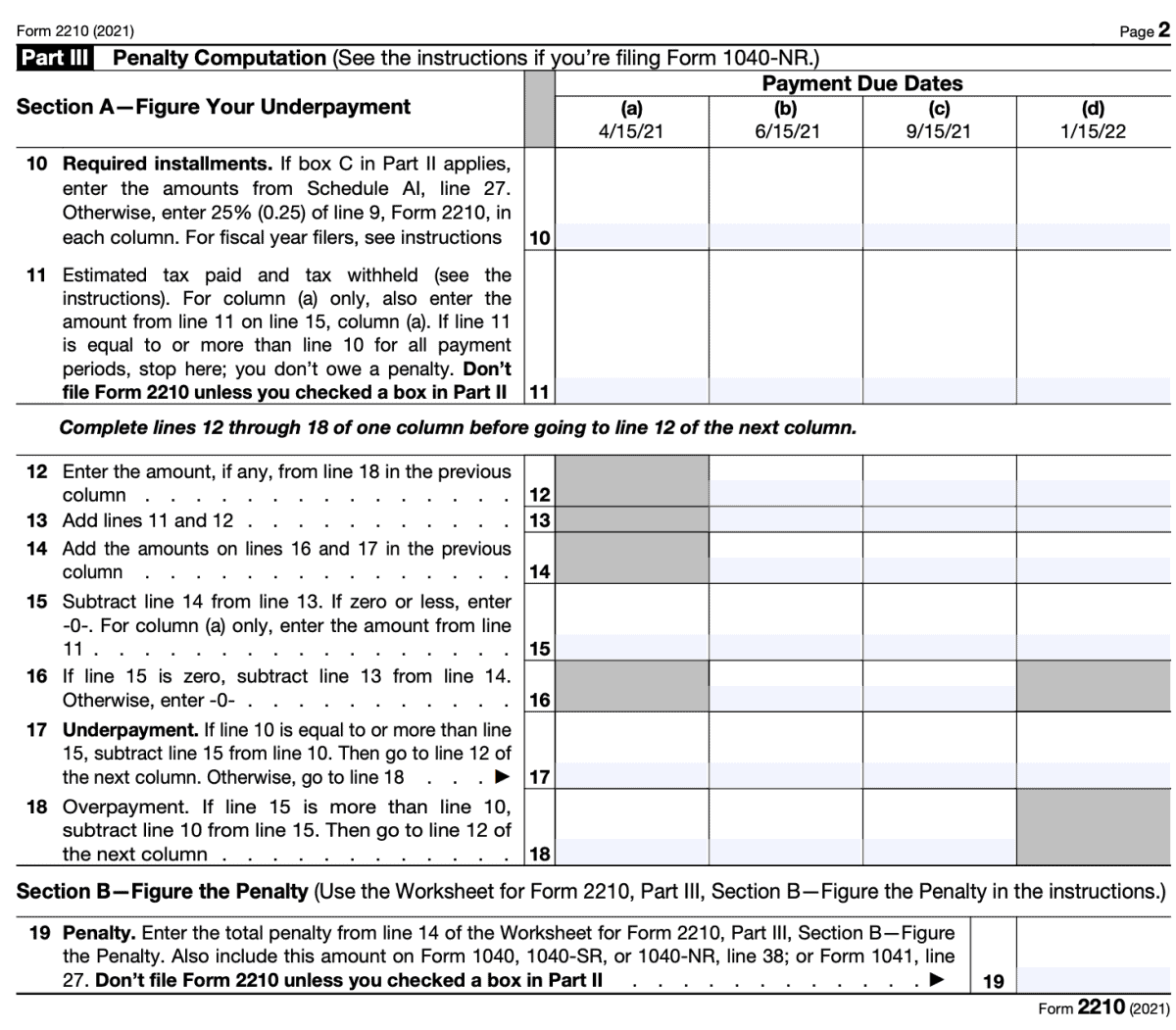

Planning ahead for your taxes is always a smart move, and one way to do that is by familiarizing yourself with IRS Form 2210 for 2025. This form helps you calculate any penalties for underpayment of estimated tax.

It’s essential to understand how to fill out this form correctly to avoid any surprises come tax time. By taking the time to learn about IRS Form 2210 for 2025 printable version, you can stay on top of your tax obligations and avoid any unnecessary penalties.

2025 – Irs Form 2210 For 2025 Printable

Understanding IRS Form 2210 For 2025 Printable

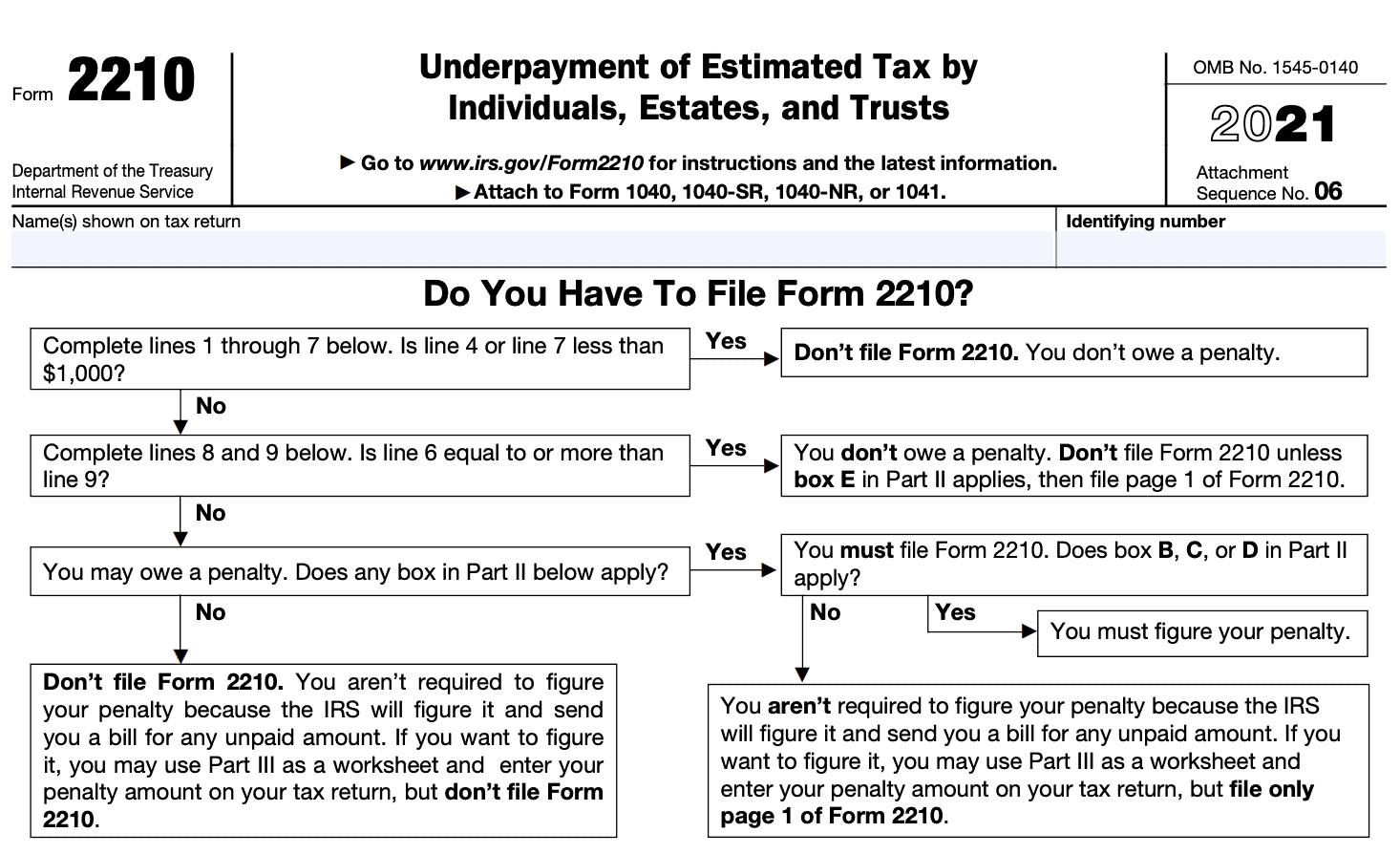

IRS Form 2210 for 2025 is used to determine if you owe any penalties for not paying enough estimated tax throughout the year. By filling out this form, you can calculate any underpayment penalties and make adjustments for the future to avoid them.

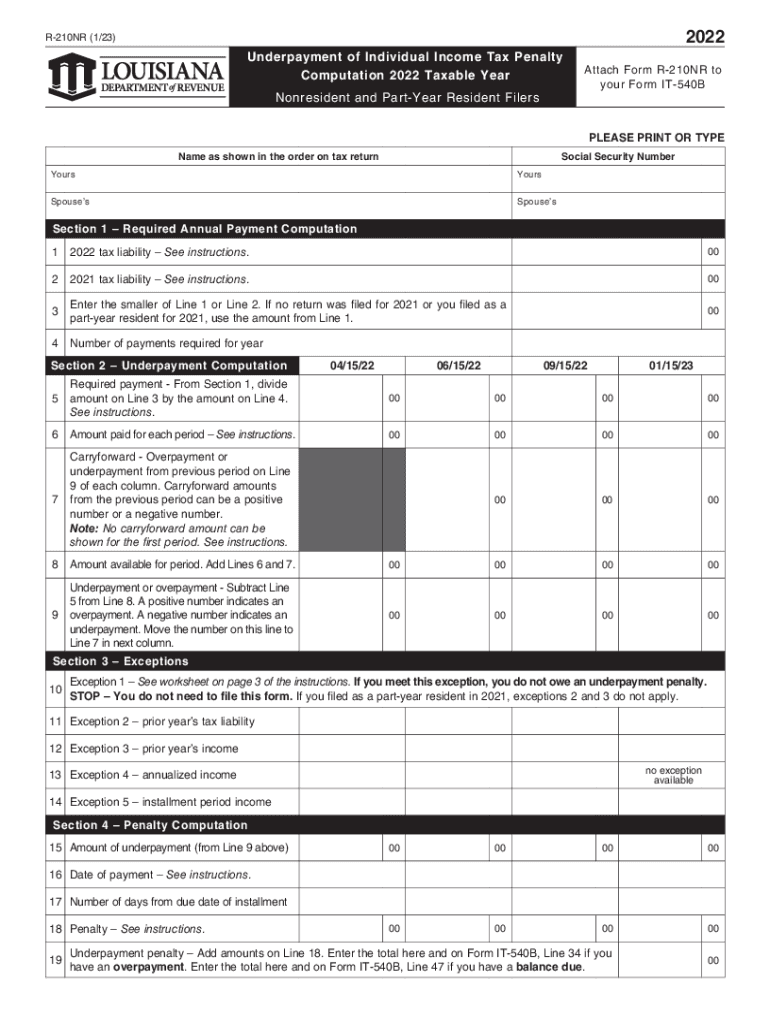

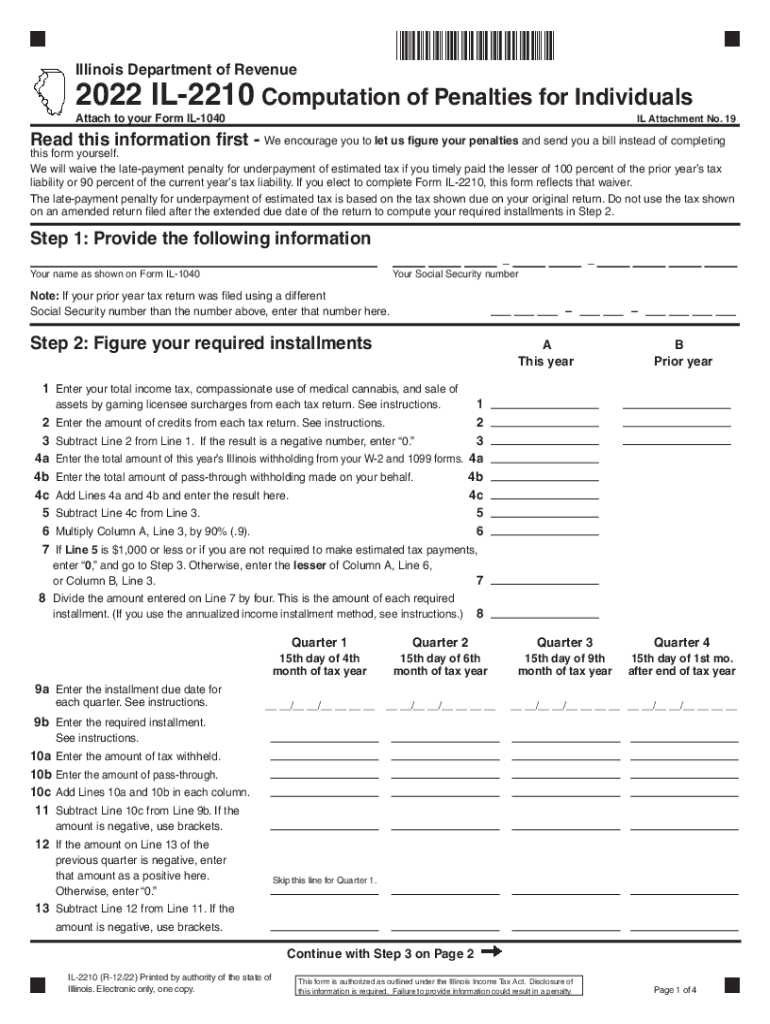

When completing IRS Form 2210 for 2025, you’ll need to provide information about your income, deductions, credits, and estimated tax payments. This form helps you determine if you met the required payment thresholds throughout the year.

By using the printable version of IRS Form 2210 for 2025, you can easily work through the calculations and ensure that you’ve accurately reported all necessary information. This form is designed to help taxpayers avoid any penalties for underpayment of estimated tax.

Take the time to review IRS Form 2210 for 2025 and familiarize yourself with how it works. By understanding this form, you can stay compliant with tax laws and make any necessary adjustments to avoid penalties in the future.

In conclusion, IRS Form 2210 for 2025 printable version is a valuable tool for taxpayers to calculate any underpayment penalties and ensure they are meeting their tax obligations. By using this form, you can stay on top of your taxes and avoid any surprises when it comes time to file.

Form 2210 Fill Out Sign Online DocHub

2210 Computation 2022 2025 Form Fill Out And Sign Printable PDF

IRS Form 2210 Instructions Underpayment Of Estimated Tax

Form 2210 Ready Understanding Underpayment Of Estimated Tax For